One of our MPH courses, we had to do an exercise in which we figured out how to balance the federal budget. We had to do it through making spending cuts alone, and it was unbelievably difficult. It's a good reality check to have to weigh what you want to have happen with the realities of what else would have to be sacrificed to get it. It's a reality check I think more people should engage in when talking about social and health-related programs, taxes, and what cuts and increases really mean when we stop playing year-to-year budget shell games.

The New York Times has

a new interactive feature up letting you try that exercise, both by cutting programs and increasing various taxes, with an

article explaining how they made their calculations and what the long-term implications of the deficit fight will be:

It [the long-term deficit] comes from the projected growth of Medicare, Medicaid and, to a lesser extent, Social Security. It is the result of baby boomers’ having paid far less in taxes than they will draw in benefits. “The reason we find ourselves in this situation,” said Mr. Bowles, the former chief of staff for President Bill Clinton, “is that we’ve made promises we can’t keep.”

The deficit puzzle focuses on the year 2030 because it is far enough away that the boomers’ retirement will weigh heavily on the budget but near enough that reasonable budget estimates exist. By 2030, the needed deficit cut will equal about 5.5 percent of annual economic output.

By comparison, domestic discretionary spending — all of it, including Head Start, college financial aid, the F.B.I., medical research and airline safety — will add up to about 3 percent of economic output, according to Congressional Budget Office projections. Military spending will equal about 4 percent.

So the solution will have to revolve around tax increases and changes to health care and Social Security. And the country cannot wait until 2030 to implement most of the changes, notes Alan Auerbach, an economics professor at the University of California at Berkeley. If it did, the interest on the national debt could become crushingly large. Deficit cutting will probably be a regular part of politics for the next couple of decades.

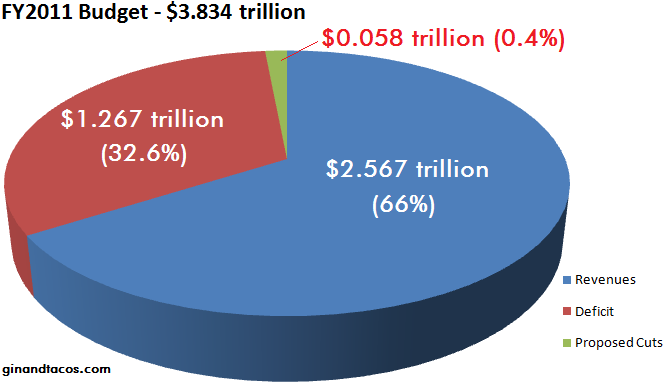

It's very popular to talk about cuts in discretionary spending - "let's cut Head Start", "let's stop spending on military technology and spend it on education" but the truth is, entitlement spending is by far our biggest budget item and health care makes up a big chunk of that. Thinking about how to contain health care costs and yes, how to ration health care (not whether to ration health care, since it is already rationed, but how) are going to be a big part of this debate.